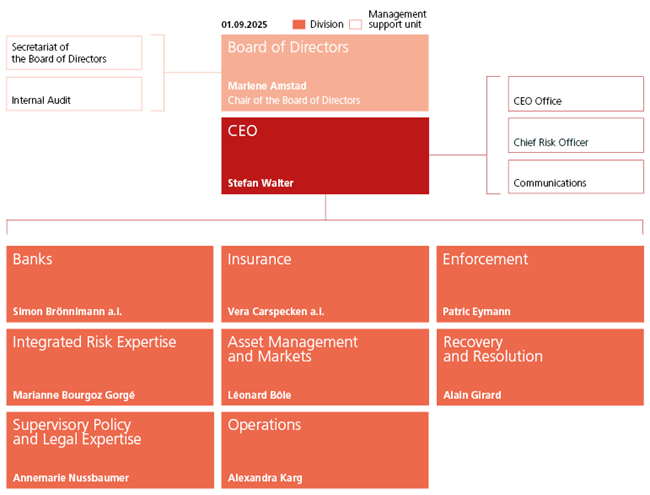

Eight divisions

Three divisions at FINMA assume responsible for its supervisory activities. Cross-divisional functions are consolidated in five further divisions.

Three supervision areas

Licensing and supervising banks and securities firms are the responsibility of the Banks division. The Insurance division performs the same tasks for the insurance sectors. Responsibility for the supervision of institutions and products in the area of individual and institutional asset management and financial market infrastructures, as well as for the recognition and supervision of self-regulatory organisations (SROs) and supervisory organisations (SOs) lies with the Asset Management and Markets division.

Five divisions with a cross-divisional function

The Integrated Risk Expertise division provides the supervisory divisions with expertise in data-driven supervision, the analysis of financial and non-financial risks and the operational resilience of supervised institutions. It is also responsible for the planning, implementation and quality assurance of FINMA’s on-site supervisory reviews. The Enforcement division is responsible for the enforcement of supervisory law in all areas and for market supervision.

The Supervisory Policy und Legal Expertise division’s main areas of responsibility are international cooperation, FINMA-relevant regulation, legal services and compliance. The Recovery and Resolution division is responsible for measures to stabilise supervised companies in the event of a crisis, for their emergency and resolution planning and for any restructuring, liquidation and insolvency proceedings. The Operations division provides FINMA staff with the required tools and performs internal service and control functions.