Correction on real estate and mortgage market 2020

Negative interest rates continue to pose a risk of bubbles developing in various asset classes, particularly in the real estate market. Due to the persistently low interest rate environment, investors are still searching for higher-yielding investments. As a result, they are investing increasingly in real estate despite rising vacancy rates and falling rents. In doing so, they are accepting ever lower initial returns. Previous trends have been sustained this year, surprisingly.

The corona pandemic is adding to the strains on the real estate market – and especially the market for offices and commercial buildings – by accentuating the imbalance of supply and demand. In particular, the upswing in the market for office space has been halted for the time being: rents are falling, and with more people working from home there is little prospect of any expansion in office floorspace usage – hence the pressure on prices. The boom in online trading due to the corona pandemic is also dragging down prices and rents for retail floorspace.

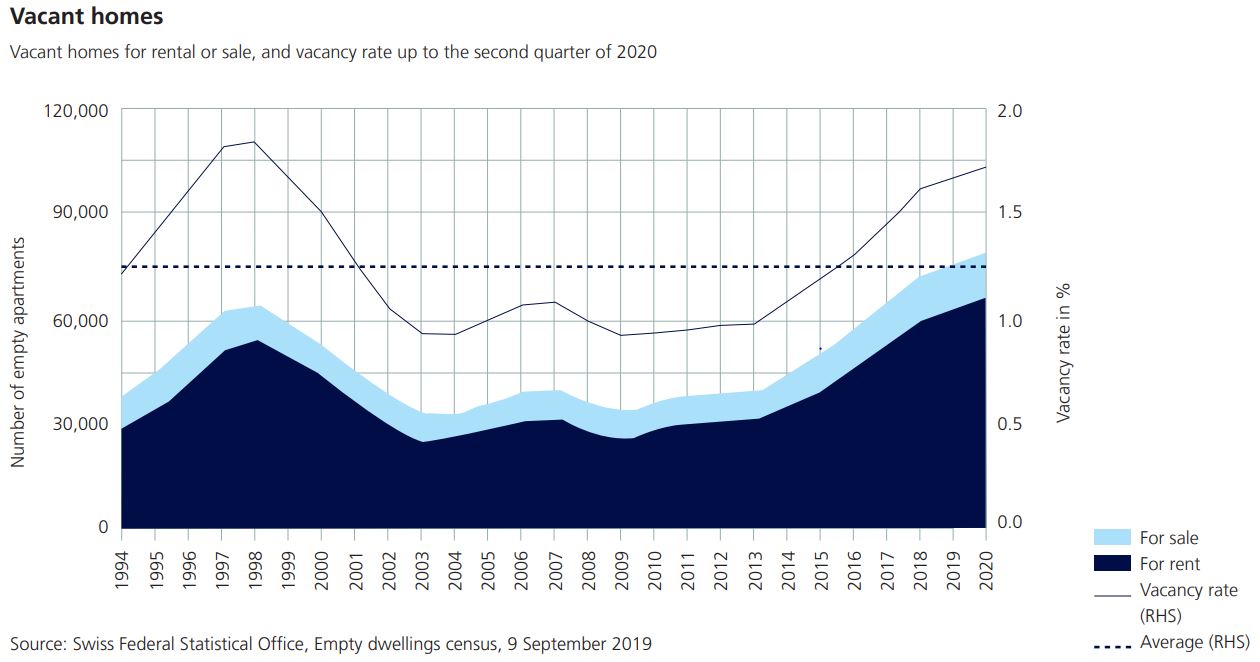

Moreover, net immigration declined in the first half of 2020. 1.72 percent of all homes (for owner occupation or for rent) are currently vacant. This is a total of about 78,800 units. The following chart illustrates the trend over time. By contrast, prices of owner-occupied homes have continued to rise since the outbreak of the corona pandemic. Vacancy rates here have been relatively constant over the past years. The supply overhang problem is less pronounced in this segment.

The consequences of a real estate crisis with sharp price corrections could be significant, with banks, insurers and real estate funds all being equally affected.

- Insurers and banks: FINMA has performed stress tests with insurance companies and banks, taking scenarios of a possible real estate crisis. The results showed that life insurers as well as banks are especially vulnerable to real estate price corrections.

- Real estate funds: Valuation losses and the resulting outflows could cause liquidity problems for real estate funds. Owing to such strong outflows, foreign real estate funds have thus been “gating” during the corona pandemic. By responding in this way, fund managers seek to avoid having to sell off large numbers of fund holdings due to a sudden surge in redemptions. In contrast to the situation abroad, Switzerland has not seen any gating during the pandemic other than in a few short-lived instances

(From the Risk monitor 2020)