Dossier on money laundering prevention

Focus on high-risk clients in the context of combating money laundering (2024)

As a cross-border wealth management hub for private individuals, the Swiss financial centre is particularly exposed to money laundering risks, and FINMA set out its expectations regarding this to the supervised institutions once again in 2024.

Money laundering supervision: findings from the on-site supervisory reviews (2024)

FINMA also conducted on-site supervisory reviews as part of its work to combat money laundering. These brought to light a number of different findings.

Money laundering (2024)

The Swiss financial centre is a leading global cross-border wealth management hub for private clients. This makes it particularly exposed to money laundering risks. Money laundering risks therefore remained high in the year under review.

Money laundering supervision: focus on money laundering risk analysis and complex structures (2023)

FINMA focused on money laundering risk analysis in its 2023 money laundering supervision. Its goal was to positively influence risk management at financial institutions.

Money laundering and sanctions (2023)

The Swiss financial centre is a leading global cross-border wealth management hub for private clients. This makes it particularly exposed to money-laundering risks.

Money laundering supervision (2022)

FINMA focused on money laundering risk analysis in its 2023 money laundering supervision. Its goal was to positively influence risk management at financial institutions.

Enforcement proceedings due to shortcomings in consolidated supervision in the area of combating money laundering (2022)

In the year under review, FINMA concluded two proceedings that focused on the requirements to combat money laundering and terrorist financing in relation to a financial group.

Money laundering and sanctions

The Swiss financial centre is a leading global cross-border wealth management hub for private clients. This makes it particularly exposed to money-laundering risks.

Money laundering: Focus of conduct supervision (2021)

In the year under review, FINMA analysed numerous offered and planned services in the crypto area. It provided the institutions with further details of its expectations in relation to the money laundering regulations.

Money laundering supervision in numbers (2021)

Preventing money laundering plays an important role in the prevention of crime. Well-functioning anti-money laundering measures are also essential to the success of the financial centre. As part of its supervisory activity, FINMA strives to prevent money laundering.

Risk situation in connection with money laundering (2021)

The Swiss financial centre is a leading global cross-border wealth management hub for private clients. This makes it particularly exposed to money-laundering risks.

Money laundering: Focus of conduct supervision (2020)

Effective conduct supervision builds trust in Switzerland as a financial centre. FINMA once again set its focus on combating money laundering and terrorist financing during 2020, particularly in connection with blockchain-based transactions.

Money laundering supervision in numbers (2020)

Preventing money laundering plays an important role in the prevention of crime. A well -functioning anti-money laundering mechanism is also essential to the success of the financial centre. As part of its supervisory activity, FINMA strives intensively to prevent money laundering.

Money laundering: focus of conduct supervision (2019)

According to the Risk Monitor published for the first time in December 2019, money laundering remains one of the principal risks for FINMA’s supervised institutions and the Swiss financial centre.

Risk situation in connection with money laundering (2019)

The Swiss financial centre is a leading global cross-border wealth management hub for private clients. This makes it particularly exposed to money-laundering risks.

Addressing global money-laundering scandals (2018)

In 2018 FINMA concluded its investigations and proceedings against institutions involved in recent global corruption and money-laundering scandals (Malaysian sovereign wealth fund 1MDB, FIFA, Petrobras).

Progress in combating money laundering (2018)

In recent years, banks and asset managers have been involved in numerous money laundering affairs in relation to major corruption scandals. With regard to combating money laundering, FINMA therefore focused its supervisory activities on how institutions deal with international money-laundering cases.

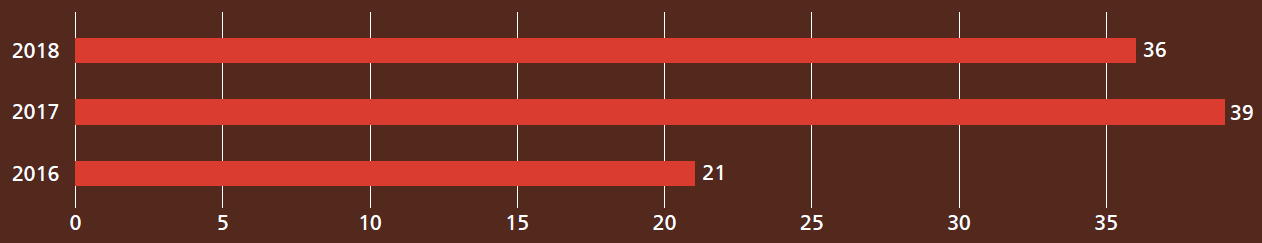

At a glance: intensive money-laundering supervision (2018)

FINMA’s strategic aim is to have a long-term positive influence on institutions’ conduct in preventing money laundering. It therefore makes concerted efforts in the areas of supervision and enforcement to prevent money laundering.

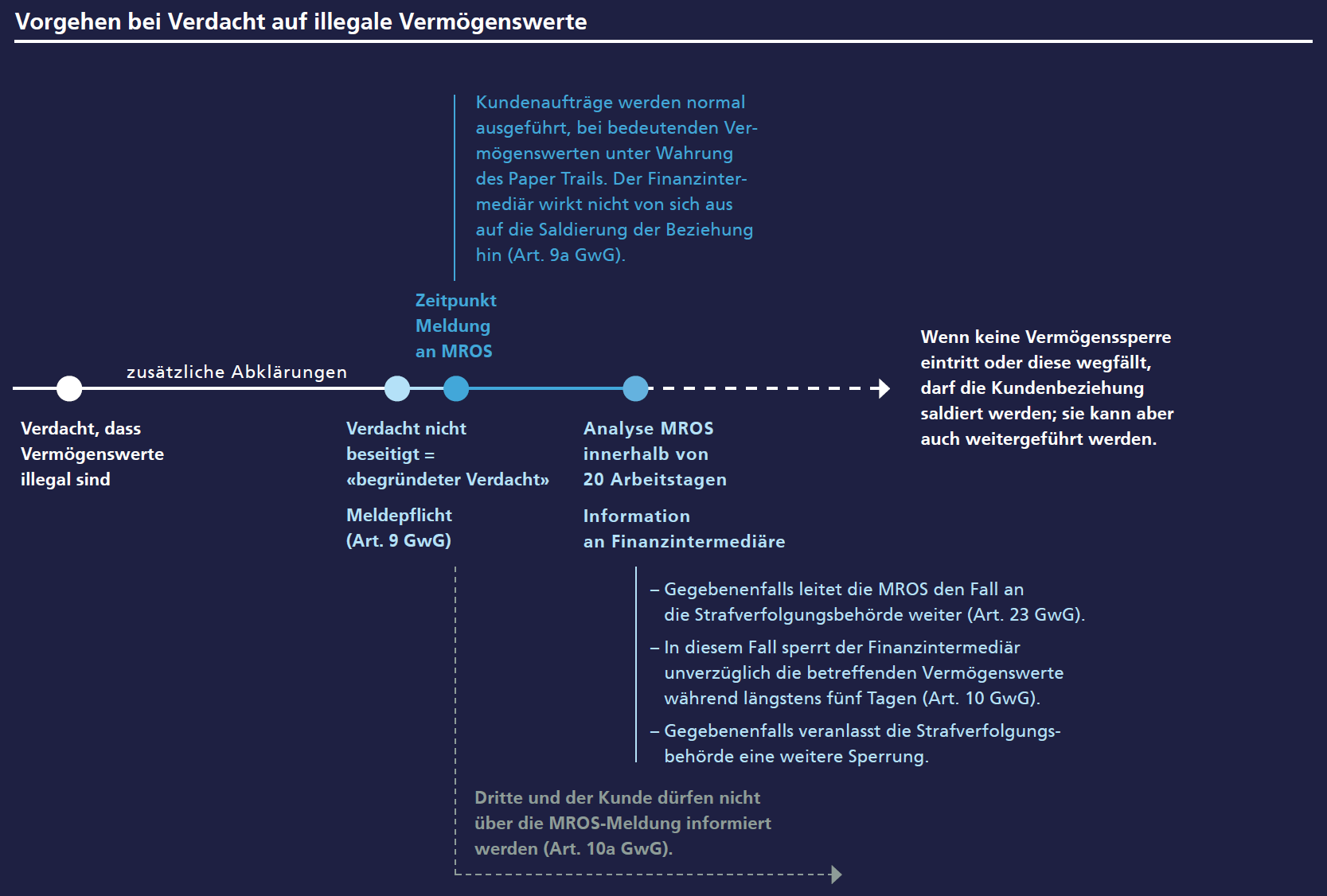

Case law and practice for reporting requirements (2017)

The Anti-Money Laundering Act (AMLA) specifies the procedures a financial intermediary should follow if it suspects assets might be illegal.

Money laundering prevention: a strategic goal (2017)

FINMA has set itself the goal of achieving a sustained impact on institutions in their efforts to prevent money laundering. Its focus in 2017 was on institutions’ reporting systems and their risk management.

Follow-up measures to the FATF country review (2017)

The Financial Action Task Force (FATF) conducted its fourth country review of Switzerland from 2015 to 2016. It examines a country’s anti-money laundering and counter-terrorist financing system, with a particular focus on financial market regulation.

-

Additional documents

-

{{~it.Items :item}} {{~}} {{?it.NextPageLink}} {{?}}

result(s) found