Dossier on the mortgage market

Risk levels associated with real estate and mortgages remain high (2024)

The risks associated with real estate and mortgages are of great importance to the Swiss financial centre. FINMA therefore placed a major supervisory focus on credit default risks and risks arising from valuations.

Risks associated with real estate and mortgages (2024)

FINMA monitors mortgage credit risk closely. There has been a slowdown on the Swiss real estate market since the publication of the last Risk Monitor. The rate of price increases decelerated in the residential segment, while prices stagnated in the investment segment.

Significant risks in the real estate and mortgage markets 2023

The mortgage sector is of vital importance to the Swiss financial centre. In 2023, FINMA therefore continued to monitor the real estate and investment market closely, taking corrective action in cases where it identified undesirable developments in the loans business.

Climate risks: Analysis of transition risks inherent in mortgage portfolios 2023

During 2023, FINMA addressed the issue of climate risks in the course of its supervisory exchanges with larger institutions and communicated its expectations with regard to the management of nature-related risks. In the banking sector, it also analysed mortgage products making references to sustainability.

Credit risk: mortgages 2023

FINMA has intensified its focus on mortgage credit risk owing to the rise in interest rates. So far the changing interest rate environment has only had a fairly modest impact on residential property prices and has been reflected in weaker price growth and a decline in the number of transactions.

Significant risks in the real estate and mortgage market 2022

In the wake of tightening monetary policy, interest rates on mortgage loans also rose significantly during the course of the year. Unperturbed by this, the price trend in the real estate market, which had been increasing since 2020, continued even in 2022.

Credit risk: mortgages 2022

The credit risk associated with mortgage loans has grown in importance in recent years, as on the one hand affordability risks for newly granted mortgages increased and, on the other, fundamentals point towards an overheating of the real estate market.

Trends in the real estate market 2021

The substantial risks in the mortgage and real estate markets were further accentuated as a result of the price increases during 2021. The strong demand seen in the tenant market – also during the coronavirus pandemic – at least helped to ward off further increases in the risks faced by the residential investment property sub-market.

Correction in the real estate and mortgage market 2021

The real estate market has proved resilient in the face of the coronavirus pandemic, not least thanks to government support packages and monetary policy interventions. Indeed, mortgage volumes have actually increased further.

Trends in the real estate market 2020

The risks that had built up in the real estate market as a result of the developments in recent years were amplified due to the impacts of the coronavirus crisis. Occupier and investor markets continued to diverge, particularly in the area of residential investment property financing.

Correction on real estate and mortgage market 2020

Vacancy rates for residential investment properties, which have risen further owing to the corona pandemic, increase the level of risk in the Swiss real estate and mortgage market. Lost earnings from the rental of commercial and office property and flagging demand for office and retail space are pushing down prices in the commercial real estate segment. Moreover, growth in mortgages was more robust than expected this year

Mortgage market in supervision 2019

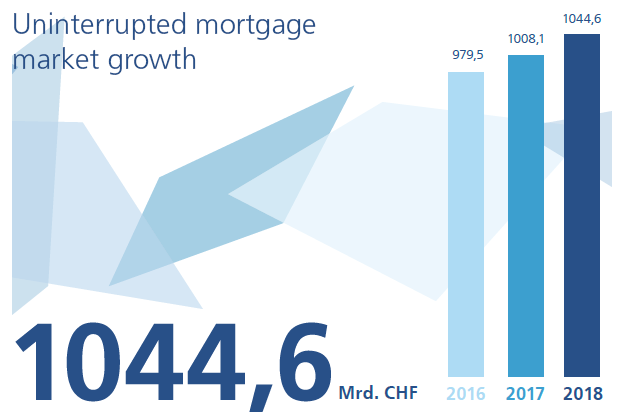

FINMA has repeatedly emphasised the growth of mortgage market risks in recent years. The reporting year was no different as FINMA drew attention to the ongoing growth of these risks, for example at the annual media conference of 4 April 2019, where the results of the 2018 extended mortgage stress test covering 18 banks were disclosed, and in its December Risk Monitor. The latter report highlighted investment properties, which merit a closer supervisory focus as they are particularly exposed, not least due to unprecedented vacancy levels.

Risks of correction on real estate and mortgage market 2019

The sharp rise in vacancy rates for investment properties, combined with the ongoing boom in construction activity, is exacerbating the risks in the Swiss real estate and mortgage market. Previous crises have shown that financial institutions which expand their activity in the late phase of an economic cycle are particularly exposed to the risks of an ensuing economic downturn.

Mortgage market measures 2018

The strong vacancy growth in residential investment properties and the sustained high level of construction have increased Swiss real estate market risks. Previous crises have shown that those institutions assuming risk at a late stage in the cycle are the most exposed to an economic downturn.

Imbalances in investment properties 2017

Persistently low interest rates also mean that investors still face a dearth of supposedly low-risk return opportunities, and investing in real estate therefore remains attractive.

Mortgage market slightly calmer 2016

Momentum in the Swiss mortgage market eased slightly in 2016, especially where owner-occupied residential properties were concerned.

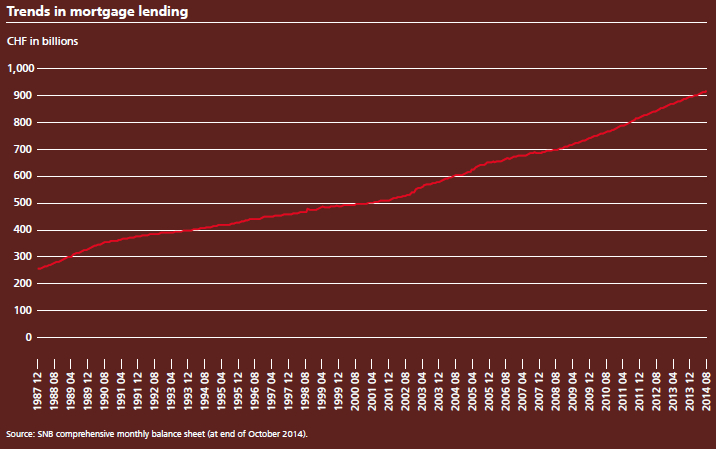

Interest rate risks and mortgage growth 2014

In the low interest rate environment, monitoring and managing interest rate risks remains extremely important.

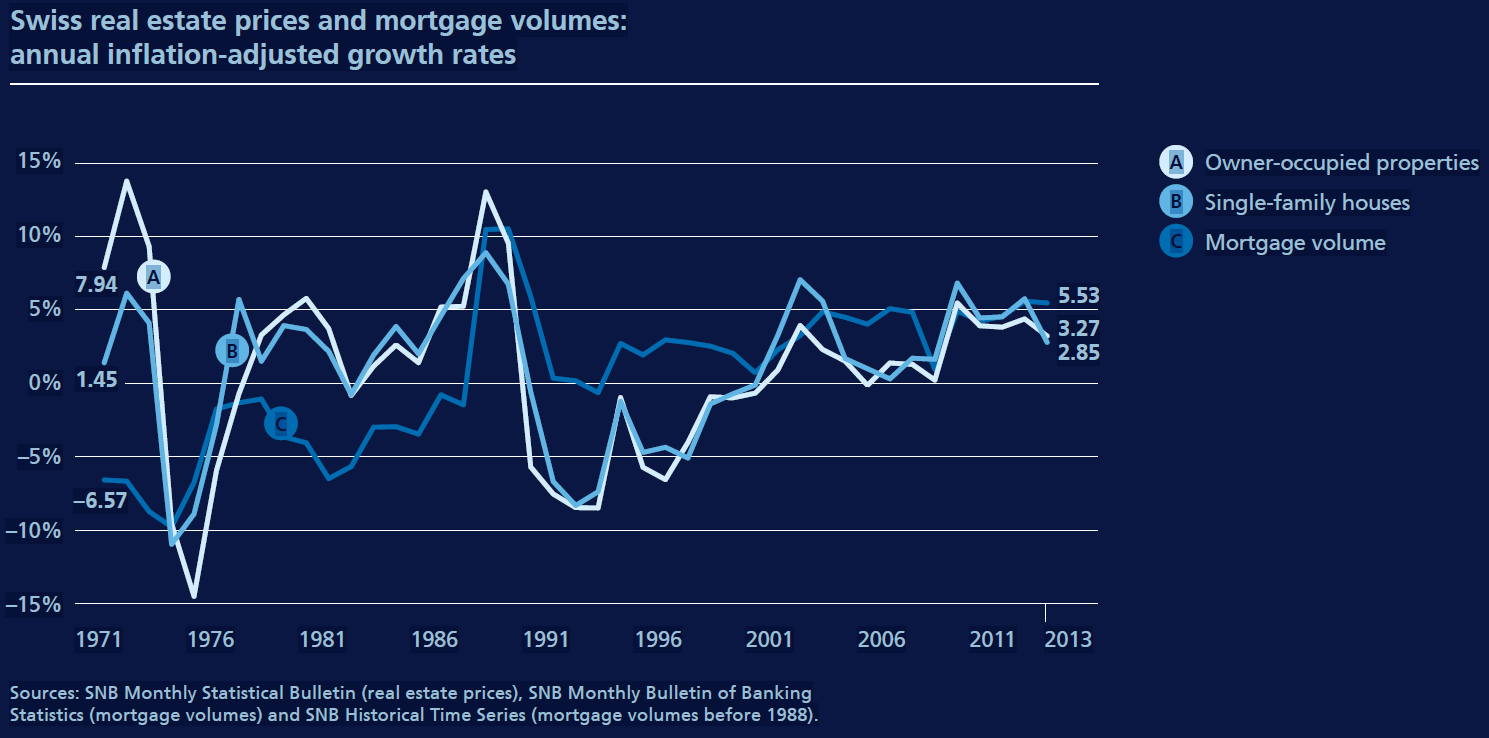

Real estate price growth slows slightly after package of measures in 2014

Price growth slowed slightly following the increase in the countercyclical buffer and the somewhat stricter rules on amortisation and central parameters of self-regulation. However, imbalances and the factors driving them persist.

Real estate market remains tight 2013

Despite self-regulatory measures and the countercyclical capital buffer, real estate prices and mortgage volumes once again rose in 2013 – somewhat more slowly than before, but still faster

than gross domestic product. Excessively slow amortisation and, in some cases, poor financial sustainability of mortgages and investment properties are giving rise to risks.

-

Additional documents

-

{{~it.Items :item}} {{~}} {{?it.NextPageLink}} {{?}}

result(s) found