Insurance division

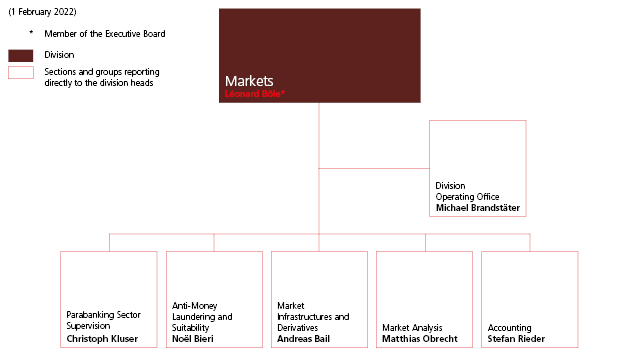

The Markets division has a broad area of responsibility, ranging from the supervision of financial market infrastructures and assessing subordination issues in the FinTech segment to the recognition of rating agencies and the combating of money laundering.

Supervision of the parabanking sector

This group supervises recognised self-regulatory organisations (SROs ) with regard to the combating of money laundering and terrorist financing. This includes, in particular, the approval of changes to regulations and ongoing communication with self-regulatory organisations regarding the auditing of affiliated financial intermediaries. Depending on the membership structure, organisation and/or supervisory policy, the SROs are allocated to risk categories.

The group is also responsible for authorising and monitoring supervisory organisations (SO). It checks as part of its licensing process, whether the SO and the persons with administrative and managerial responsibilities meet legal requirements. The Group supervises the licensed SO on an ongoing basis. If FINMA identifies violations or failings within its supervisory remit with respect to the SO, it will take the measures required to restore compliance.

Anti-money laundering and suitability

The Anti-Money Laundering and Suitability group represents FINMA's centre of competence for the combating of money laundering and ensuring compliance with conduct rules vis-à-vis clients (suitability). In addition to this cross-divisional function, this group also handles international issues and carries out regulatory tasks.

Supervision of financial market infrastructures

Financial market infrastructure regulation is based on a number of laws: the Financial Market Infrastructure Act (FinMIA), the Banking Act (BA), the Stock Exchange Act (SESTA) and the National Bank Act (NBA). The services provided by financial market infrastructures (i.e. trading, clearing, settlement and securities safe keeping) form the essential backbone of an efficient and functional capital market. They also represent an essential link to international capital markets.

FINMA is also responsible for supervising financial market infrastructures. However, the Financial Market Infrastructure Act (FinMIA) states that systemically important financial market infrastructures are also subject to monitoring by the Swiss National Bank (SNB).

FinTech

The "Market Analysis" group is in charge of licensing persons pursuant to Article 1b of the Banking Act (FinTech licence) as well as DLT trading facilities (distributed ledger technology) and supervising licensed institutions. The group also manages the FINMA FinTech Desk in its role as a FinTech competence centre. The FinTech Desk is available to answer questions from interested parties regarding the legal classification of FinTech projects. In this capacity it also handles enquiries about whether FinTech business models are subject to the financial market laws. Besides this, the Markets division supports the other divisions in FinTech matters and participates in working groups on FinTech topics.

Rating agencies

Supervised institutions (banks, securities dealers, insurance companies) may use the ratings of recognised rating agencies to satisfy supervisory requirements set out in financial market law. The "Market Analysis" group within the Markets division is responsible for the recognition of rating agencies whose ratings can then be used for regulatory purposes.

Accounting

The Accounting group deals with all accounting matters and assists the other divisions with any questions they may have about national and international accounting standards used by supervised institutions or issued by FINMA. Besides the internal support it provides, the Accounting group is also the contact point for external queries about accounting.

Audit Firm Coordination group

FINMA has been empowered by the Federal Council (FINMA Auditing Ordinance) to regulate the content and execution of audits, as well as the type of reporting (FINMA Circ. 2013/3). Audit firms extend FINMA’s reach and conduct their audits in line with the rules set by FINMA. They are supervised by the Federal Audit Oversight Agency (FAOA). The Audit Firm Coordination group, which is also attached to the Markets division, coordinates audit-related matters and collaborates with the FAOA.