Case law and practice for reporting requirements (2017)

The provisions governing special duties of due diligence as outlined in Article 6 of AMLA require financial intermediaries to clarify the economic background and purpose of a transaction or business relationship if it appears unusual. The investigations carried out must be documented to enable third parties to reach a well-founded judgement on the transaction or business relationship and establish whether it complies with AMLA.

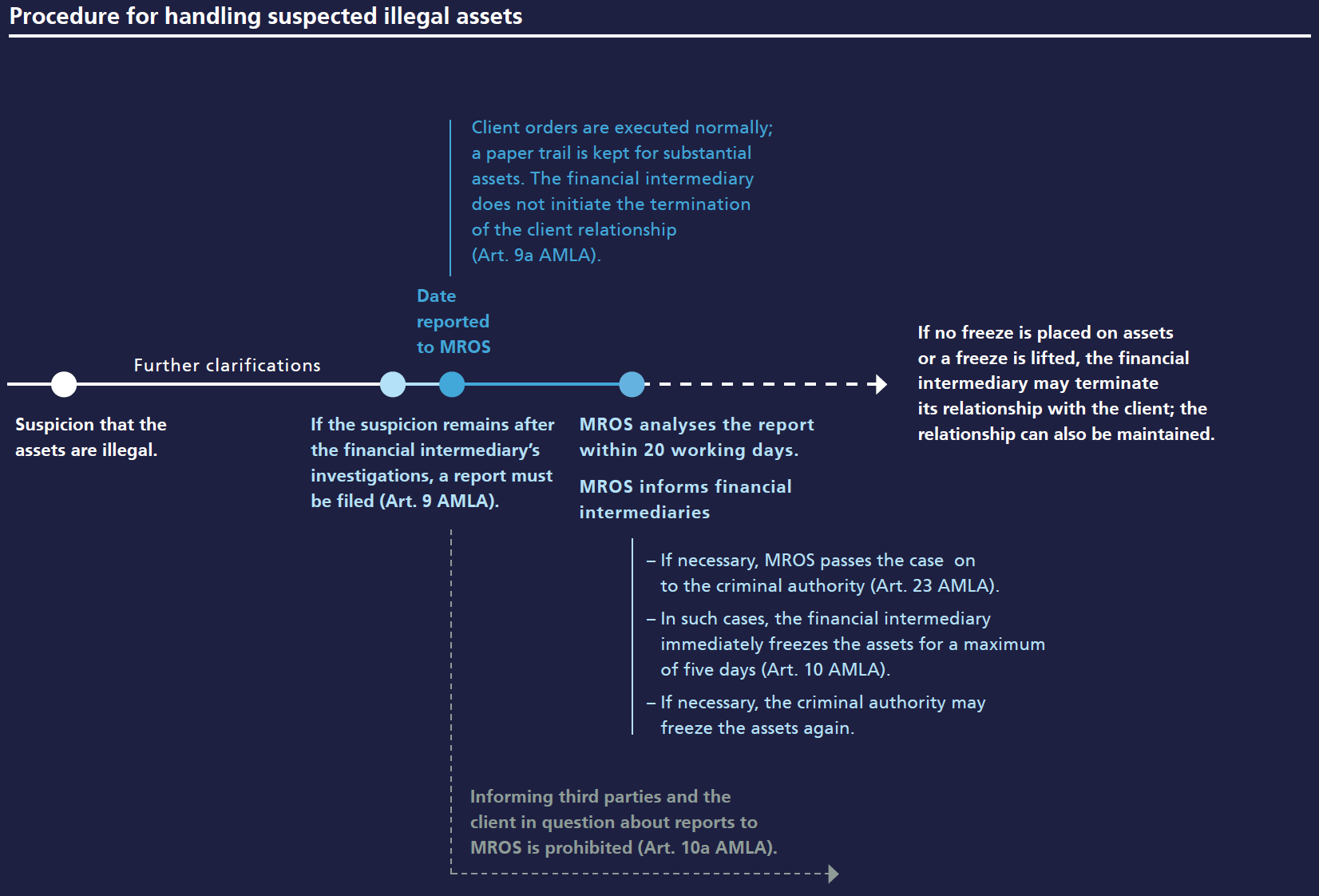

Reasonable suspicion exists when the results of these clarifications fail to refute the suspicion that the assets are linked with a crime. The financial intermediary must report such business relationships to MROS (duty to report under Article 9 AMLA; see decisions of the Swiss Federal Criminal Court SK.2017.54 of 19 December 2017 and SK.2014.14 of 18 March 2015, consid. 4.5.1.1). If it is unclear whether a report must be filed, the financial intermediary may still do so (reporting right in accordance with Article 305ter para. 2 SCC).

(From the Annual Report 2017)