Artificial intelligence: FINMA sets out its supervisory expectations

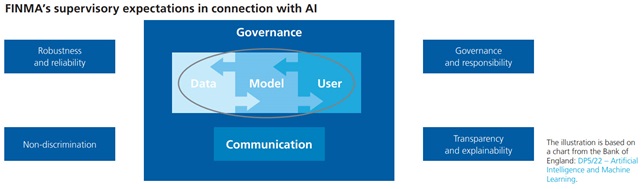

In order to limit the risks associated with using AI, FINMA has set out its supervisory expectations regarding the use of AI in the business processes of supervised institutions. The expectations, which focus on four areas (see chart on page 33), have been coordinated and refined with various stakeholders and are described in detail in the 2023 Risk Monitor.

In the dynamic area of AI, FINMA relies strongly on a close exchange with experts in Switzerland and abroad, as well as with financial market institutions that utilise AI. It can be deduced from the discussions that the majority of institutions that utilise AI are monitoring the developments in this area very closely. But many are also currently experimenting in fields of application that involve only limited risks. Here, it is rarely the aim to achieve full automation, and the human factor is still considered very important in the process. The industry welcomes FINMA’s technology neutrality and risk-based approach. As AI essentially represents a technical evolution, most institutions do not consider the risks to be fundamentally new and are already addressing them within their existing risk management processes.

In addition to communicating its supervisory expectations, FINMA is looking into the adequacy of risk management and governance relating to AI at the supervised institutions. In order to identify, limit and monitor AI-specific risks, FINMA has been conducting on-site inspections and supervisory exchanges with financial institutions that deploy AI extensively or in areas relevant for supervision since the fourth quarter of 2023. In addition, FINMA has taken a closer look at initial applications in asset management, transaction monitoring and liquidity management as part of its ongoing supervision.

(From the Annual Report 2023)