Resolution report 2021

Every year FINMA assesses the progress made in recovery and resolution planning by the systemically important financial institutions Credit Suisse, UBS, PostFinance, Raiffeisen, Zürcher Kantonalbank and the systemically important financial market infrastructures (FMIs) SIX x-clear and SIX SIS. It published the first resolution report in 2020 and is reporting here in depth on the status of progress in 2021. Unless otherwise stated, the cut-off date for the evaluation was the end of 2020.

Significant progress

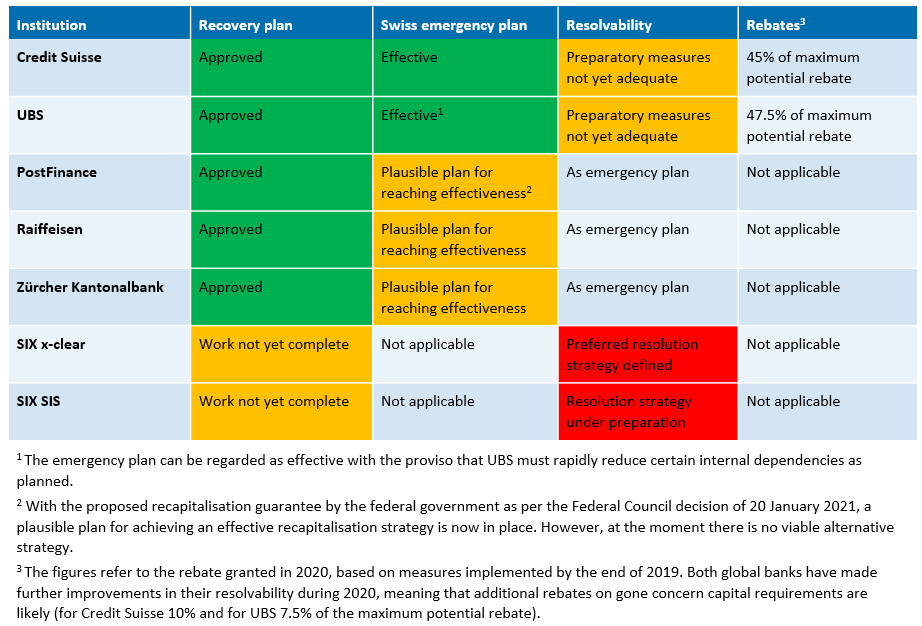

The three domestic systemically important banks Raiffeisen, Zürcher Kantonalbank and PostFinance advanced their emergency planning substantially compared with last year. For the first time all three institutions have a credible resolution strategy to ensure continuity of their Swiss systemically important functions in crisis conditions. However, further steps needed for the emergency plans to be effective include the build-up of the loss-absorbing capacity required for recapitalisation in a crisis to the full amount, and in the case of PostFinance also the development of an alternative strategy. FINMA continues to regard the Swiss emergency plans of the global systemically important banks UBS and Credit Suisse as effective and ready to implement.

The large banks made progress on their global resolvability with further improvements in their operational capabilities, particularly with regard to operational disentanglement, crisis-related recapitalisation and providing information on liquidity and capital in a crisis. To achieve FINMA’s strategic goal of completing the “too big to fail” planning (TBTF) by 2024 at the latest, further steps are needed, both by the authorities and the banks.

In the case of the central counterparty SIX x-clear, FINMA has defined its preferred resolution strategy.

Recovery and resolution plans

The main components of the “too big to fail” work that FINMA evaluates annually are as follows:

Recovery plan: This sets out how the systemically important bank or financial market infrastructure would stabilise itself in a crisis. This plan requires FINMA’s approval.

Swiss emergency plan: In this plan the systemically important bank details how it would ensure uninterrupted continuity of its systemically important functions in Switzerland (particularly access to bank deposits and payments) in a crisis. FINMA must review this plan and evaluate whether it is ready to be implemented.

Resolution plan: FINMA produces a global resolution plan for Credit Suisse and UBS. This lays out how the entire global banking group would be recapitalised, restructured and/or liquidated, or partially liquidated, in a crisis. FINMA is also required to produce suitable resolution plans for the domestic systemically important banks and financial market infrastructures. It also evaluates the resolvability of the large banks in a structured manner based on whether they have made adequate preparations to enable the plan to be implemented successfully.

Rebates: FINMA can grant the two large banks rebates on their capital requirements if they have made tangible improvements in their global resolvability.

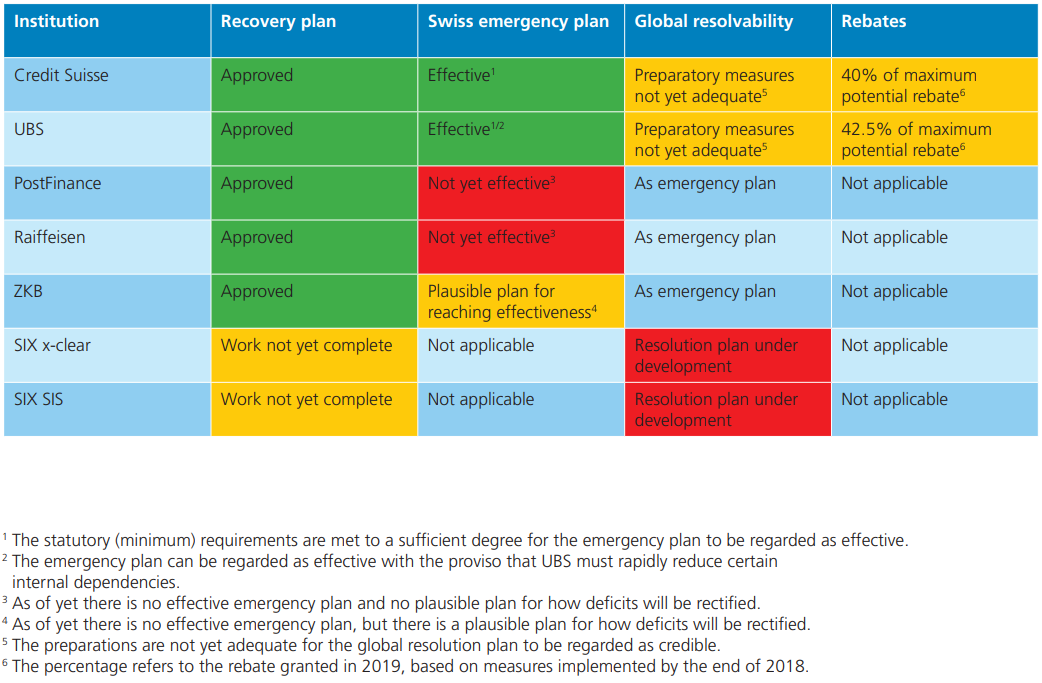

Overview of the progress of work as at the end of 2020

The systemically important banks and financial market infrastructures made further progress in 2020. Nonetheless, a range of actions are still needed to complete the recovery and resolution planning.

Overview of the current status of recovery and resolution planning:

The emergency plans of the three domestic systemically important banks have considerably improved compared with the position at the end of 2019. However, none of them is fully effective yet. For example, Zürcher Kantonalbank, Raiffeisen and PostFinance meet FINMA’s requirements with regard to holding sufficient liquidity for emergency planning. They also have plausible strategies for raising the capital needed for a successful resolution within the required timeframe. However, none of the three banks have yet raised or reserved sufficient loss-absorbing (or “gone concern”) funds for a resolution scenario.

FINMA approved the 2019 versions of the systemically important banks’ recovery plans in 2020. It will review whether the revised plans still meet the requirements for approval in the course of 2021.

FINMA still views the Swiss emergency plans of the large banks UBS and Credit Suisse as effective, although UBS remains subject to the proviso that it continue to reduce certain financial interdependencies within the group according to the agreed schedule.

The large banks Credit Suisse and UBS made further progress on their global resolvability during 2020. With regard to operational disentanglement, the banks improved their security of access to financial market infrastructures in a crisis. They enhanced their capability to carry out a group-wide recapitalisation, undertake the necessary valuations and reassess their liquidity and capital requirements on an ongoing basis in a crisis and inform FINMA of these. Some final areas of work, particularly in the areas of financial disentanglement and post bail-in restructuring, remain outstanding.

The recovery plans of the systemically important financial market infrastructures (FMIs) improved further compared with last year’s versions, but do not meet the requirements for approval yet.

FINMA has produced a draft of its preferred resolution strategy for the central counterparty SIX x-clear. This aims to temporarily continue the system-critical functions for a maximum of six months combined with a simultaneous wind-down of all of its operations.

Progress of work as at the end of 2020

On the status of resolution planning by the large global Swiss banks

On the progress by domestic systemically important banks

On the recovery plans of the systemically important financial market infrastructures

Further information on FINMA as a resolution authority, the Swiss TBTF regime and the procedures for assessing the large banks’ resolvability in general is available here.