Resolution report 2023

Every year FINMA assesses the progress made in recovery, emergency and resolution planning by the systemically important banks Credit Suisse, UBS, PostFinance, Raiffeisen and Zürcher Kantonalbank and the systemically important financial market infrastructures SIX x-clear and SIX SIS. Since 2020, it has published a report on the current status of the work as at the end of the previous year (Resolution report 2020, Resolution report 2021, Resolution report 2022). With the publication of the 2023 Resolution report, FINMA is fulfilling its obligation under the Banking Ordinance (cf. Art. 66) for the 2022 reporting period.

The institutions submitted their emergency planning documents by mid-2022. The resolvability work by the large banks was assessed as it stood at the end of 2022.

Important changes

With further operational improvements, the large Swiss banks were able to improve their global resolvability in several areas and meet the requirements stipulated here. Resolvability means creating the conditions for successfully restructuring a systemically important bank in a crisis, or allowing it to exit the market by way of bankruptcy.

Raiffeisen’s emergency plan was deemed ready to implement for the first time, as the bank has reserved sufficient capital as at the end of 2022 for recapitalisation and continuing operations in a crisis. Due to the decision not to approve the revision proposal for the Post Organisation Act, which also included a recapitalisation guarantee by the federal government, PostFinance must now revise its recapitalisation strategy.

FINMA approved the recovery plans of the central counterparty SIX x-clear and the central securities depository SIX SIS in 2022 for the first time without conditions.

The revision of the Liquidity Ordinance to improve the “too big to fail” regime was adopted by the Federal Council on 3 June 2022. It entered into force on 1 July 2022 with an 18-month transitional period. The revision of the Liquidity Ordinance is intended to ensure that all systemically important banks have the liquidity required under Article 9 para. 2 let. b BA. This additional liquidity should guarantee that systemically important banks can absorb stronger liquidity shocks than non-systemically important banks and that they can thus meet their payment obligations even in exceptionally stressed conditions. The new liquidity requirements consist of a basic requirement and a bank-specific supplementary requirement. In the future, this will cover liquidity risks both in the recovery and resolution phases. These rules are intended to help strengthen the stability of the banks in order to reduce the probability and severity of a crisis and to avoid high resulting costs for the entire national economy. A high liquidity buffer at systemically important banks is also a key prerequisite for the public liquidity backstop planned by the Federal Council.

The merger of UBS and Credit Suisse will be taken into account in the recovery and resolution planning work by FINMA and the merged bank in the future. All systemically important institutions will continue to have to comply with the applicable requirements and FINMA will review them annually.

Recovery and resolution plans

FINMA evaluates the following main components of the “too big to fail” work every year:

-

Recovery plan: This sets out the steps the systemically important bank or FMI would take to stabilise itself in a crisis. The plan requires FINMA’s approval. The recovery plan itself is the responsibility of the bank. FINMA checks whether the plan meets the requirements of the act and ordinance as a whole without confirming whether it is ready to implement.

-

Swiss emergency plan: In this plan the systemically important bank details how it would ensure uninterrupted continuity of its systemically important functions in Switzerland, consisting primarily of access to deposits and payments, if there is a risk of insolvency. FINMA reviews these plans on a risk-oriented basis and assesses whether they are ready to be implemented or not.

-

Resolution plan: FINMA produces a global resolution plan for large international banks. This lays out how the entire global banking group would be recapitalised, restructured and/or liquidated, or partially liquidated, in a crisis. FINMA is also required to produce suitable resolution plans for the domestic systemically important banks and systemically important FMIs. As part of its assessment of resolvability, FINMA examines whether the preparatory measures taken by the large banks are sufficient to successfully implement the resolution plan.

-

FINMA resolvability assessment: FINMA granted the two large banks rebates on the requirements for additional loss-absorbing capital between 2016 and 2022 because they have made tangible improvements in their global resolvability. The banks have exhausted the maximum rebate potential (62.5% of 5.7% of risk-weighted asset and 2% of total exposure respectively) and thus have to hold correspondingly less loss-absorbing capital. From 1 January 2023, FINMA will conduct an annual resolvability assessment, taking into account the requirements of the Banking Ordinance (Art. 65a BO). If shortcomings are identified, it can now impose surcharges on the gone concern or liquidity requirements.

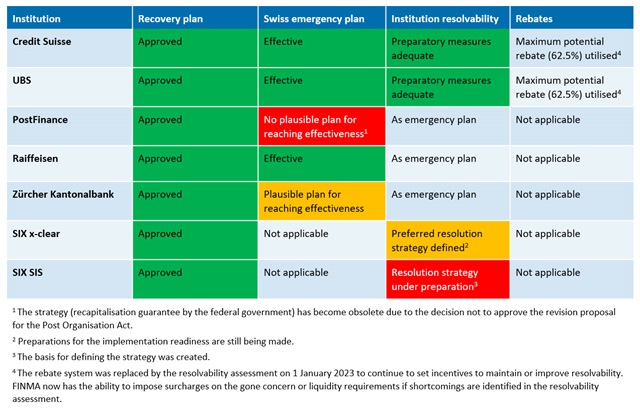

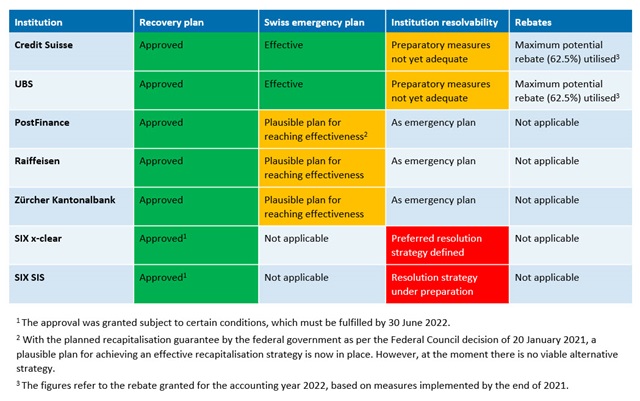

Overview of progress at the end of 2022

The systemically important banks and FMIs continued their planning work in 2022. Several steps are still needed to bring the recovery and resolution planning to a conclusion.

Overview of the current status of recovery and resolution planning:

-

Credit Suisse and UBS carried out further work towards achieving global resolvability in 2022. They implemented the requirements in the resolvability categories of “valuations” and “restructuring”. Furthermore, they conducted dry runs and coordinated with foreign authorities within the framework of the crisis management groups. Further progress towards implementation was made in the categories of “liquidity” and “completion of a bail-in”. Both banks have largely completed the work in the category of “operational continuity”. Going forward, FINMA will review the banks’ resolvability measures in depth and test whether they are effective and ready to be implemented in practice.

-

FINMA continued to view the Swiss emergency plans of Credit Suisse and UBS as ready to implement.

-

For the first time, Raiffeisen’s emergency plan meets the requirements for the uninterrupted continuation of systemically important functions if the bank were to be at risk of insolvency. As at the end of 2022, Raiffeisen has reserved sufficient capital for recapitalisation and continuing operations in a crisis. The emergency plan for Zürcher Kantonalbank (ZKB) is still not ready to implement because it does not currently have sufficient capital reserved for the event of a crisis. However, it has begun to build up the corresponding funds by issuing bail-in instruments. In contrast, PostFinance’s plan to provide the necessary funds in an emergency by means of a recapitalisation guarantee by the federal government has been rendered obsolete. Parliament did not accept the Federal Council’s proposals concerning the amendment of the Post Organisation Act and the Federal Decree on the recapitalisation guarantee to Swiss Post. The bank must therefore revise its emergency plan.

-

FINMA last approved the 2021 versions of all systemically important banks’ recovery plans in 2022. It checked whether the plans meet the requirements of the act and ordinance as a whole without confirming whether they are ready to implement. FINMA identified potential for improvement at Credit Suisse in particular, sending the large bank several written reminders to review its crisis preparations. FINMA will review revised versions again in the course of 2023.

-

The systemically important financial market infrastructures (FMIs) SIX x-clear and SIX SIS fulfilled all requirements for the approval of their recovery plans from the previous year’s assessment in the year under review. FINMA therefore approved the plans for the first time without conditions in 2022.

The authorities have largely finalised the regulatory and supervisory framework for the banks. For the FMIs, the focus in the year under review was on the timelines for actions in resolution for SIX x-clear and on dedicated information gathering for the development of a resolution strategy for SIX SIS.

Progress by the institutions at the end of 2022

Comparison with progress by the institutions at the end of 2021

Information on the rules for systemically important institutions

FINMA provides detailed information about the regulation of systemically important institutions in Switzerland, about its role as a resolution authority and the procedure for assessing resolvability, and about depositor, investor and creditor protection in the Swiss financial centre.

Terms/Glossary

Recovery plan: In the recovery plan, the systemically important institution sets out which measures it will use to ensure its stability on a sustainable basis in the event of a crisis and be able to continue its business activities without government intervention. FINMA is responsible for approving the recovery plan. The recovery plan itself is the responsibility of the bank. FINMA checks whether the plan meets the requirements of the act and ordinance as a whole without confirming whether it is ready to implement.

(Swiss) Emergency plan: Systemically important banks must demonstrate in the emergency plan that their systemically important functions can be continued without interruption in a crisis. Only functions that are critical to the Swiss economy are deemed systemically important, which includes in particular the domestic deposit and lending businesses as well as payment services. Thus it is sometimes referred to as the Swiss emergency plan. For the G-SIBs, a triggering of the emergency plan with simultaneous bankruptcy of the group is envisaged as a last resort. FINMA reviews the measures in the emergency plan with regard to their effectiveness if the bank were at risk of insolvency.

Resolvability: Resolvability describes a company’s ability to fail in an orderly manner. A systemically important bank is deemed resolvable if conditions are in place that would allow it to be successfully restructured or to exit the market by way of bankruptcy in the event of a crisis.

Resolution plan: The plan drawn up by FINMA to restructure or liquidate a systemically important institution in its entirety (in the case of an international systemically important bank the entire group, including foreign group entities, which is why this plan is also referred to as the “global resolution plan”). In this plan FINMA sets out how the restructuring or liquidation would be carried out.

Rebates: The Swiss “too big to fail” legislation contained an incentive system under which the two large Swiss banks were eligible for rebates on their gone concern capital requirements in return for improvements to their global resolvability. The banks have exhausted the maximum rebate potential (62.5% of 5.7% of risk-weighted assets and 2% of total exposure respectively) and thus have to hold correspondingly less loss-absorbing capital. From 1 January 2023, FINMA will conduct an annual resolvability assessment, taking into account the requirements of the Banking Ordinance (Art. 65a BO). If shortcomings are identified, it can now impose surcharges on the gone concern or liquidity requirements.

On the status of resolution planning by the large global Swiss banks

On the status of the emergency plans of the three domestic systemically important banks

On the status of recovery and resolution planning by the systemically important financial market infrastructures