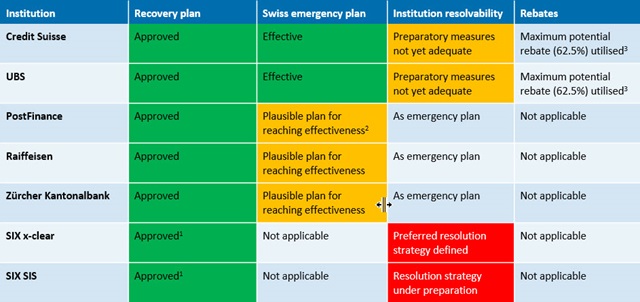

The Swiss Financial Market Supervisory Authority FINMA provides information on the status of recovery and resolution planning by systemically important Swiss financial institutions. It has approved the recovery plans of the systemically important financial market infrastructures SIX x-clear and SIX SIS for the first time, subject to conditions. FINMA sees further progress in the global resolvability of the large Swiss banks Credit Suisse and UBS. FINMA considers the emergency plans of the domestic systemically important banks PostFinance, Raiffeisen and Zürcher Kantonalbank not to be ready to implement for the time being.

Systemically important Swiss financial institutions must show in their recovery and resolution planning how they would stabilise themselves in a crisis or how they can be restructured or liquidated, while maintaining their Swiss systemically important functions. FINMA publishes an annual assessment of these plans.

Rupert Schaefer, Head of FINMA’s Recovery and Resolution division, summarises the current status: “We see further progress in the recovery and resolution plans of the institutions concerned. But there is still more work to do before the “too big to fail” planning is completed. On this last mile that now lies ahead, more than 10 years on from the global financial crisis and having learned the lessons from that, both the banks and financial market infrastructures on the one side and the authorities on the other must make the necessary effort.”

Recovery plans of financial market infrastructures approved for the first time

FINMA approved the recovery plans of the central counterparty SIX x-clear and the central securities depository SIX SIS for the first time. However, this approval is subject to conditions that must be met by the middle of the year. FINMA also coordinated the resolution strategy for SIX x-clear with the relevant authorities in Switzerland and abroad. According to this strategy, SIX x-clear must be able to continue its system-critical functions for a maximum of six months so that an orderly wind-down can take place.

Large banks make progress on their global resolvability

The large banks Credit Suisse and UBS made progress on their global resolvability. They significantly reduced obstacles to the implementation of the resolution strategy. Furthermore, FINMA once again approved the recovery plans of both large banks. FINMA also continues to view the Swiss emergency plans of Credit Suisse and UBS as effective.

Emergency plans of domestic systemically important banks still not ready to implement

FINMA considers the emergency plans of the domestic systemically important banks PostFinance, Raiffeisen and Zürcher Kantonalbank still not to be ready to implement. None of the banks has reserved sufficient loss-absorbing funds for them to be recapitalised and their operations continued in a crisis (known as gone concern capital). Raiffeisen and Zürcher Kantonalbank have sufficient free Tier 1 capital to meet the requirements of the emergency plans. Up to now, however, neither of the banks has made the necessary reallocation to the gone concern capital reserved for emergencies. By contrast, PostFinance’s plan to build up the recapitalisation funds is highly dependent on the current revision of the Post Organisation Act and the planned recapitalisation guarantee by the federal government.

Progress of the institutions’ work as at the end of 2021

1 The approval was granted subject to certain conditions, which must be fulfilled by 30 June 2022.

2 With the planned recapitalisation guarantee by the federal government as per the Federal Council decision of 20 January 2021, a plausible plan for achieving an effective recapitalisation strategy is now in place. However, at the moment there is no viable alternative strategy.

3 The figures refer to the rebate granted for the accounting year 2022, based on measures implemented by the end of 2021.

Further information

All information on Switzerland’s “too big to fail” regime

FINMA provides detailed information on “too big to fail” regulation in Switzerland, FINMA’s role as a resolution authority and the procedures for assessing resolvability and investor and client protection in the Swiss financial centre.

Contact

Tobias Lux, Spokesperson

Tel. +41 (0)31 327 91 71

tobias.lux@finma.ch

Vinzenz Mathys, Spokesperson

Phone +41 (0)31 327 19 77

vinzenz.mathys@finma.ch