Capital requirements for systemically important banks

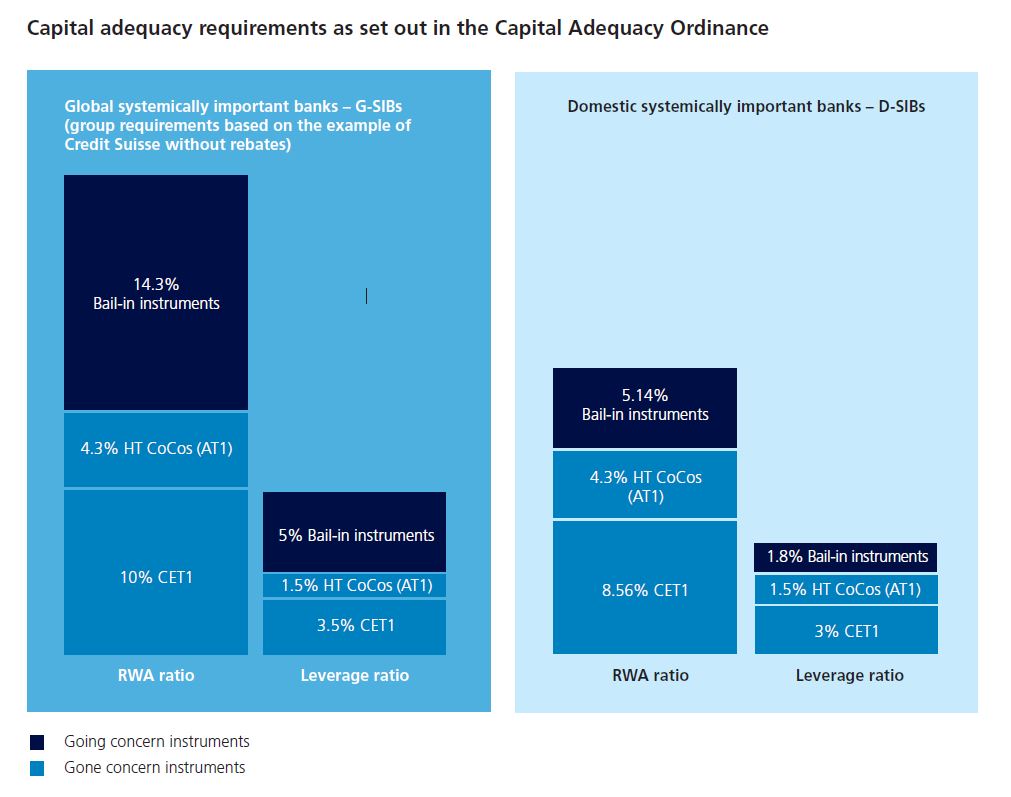

Systemically important banks must hold more regulatory capital than other banks (known as going concern capital) to make them more resilient to unexpected losses from their ongoing business activities and allow absorption of these losses. They must also provide additional loss-absorbing funds or “gone concern” capital for a crisis. The going and gone concern capital together represent the bank’s total loss-absorbing capacity (TLAC).

In line with the international standards, there are two types of capital requirement in Switzerland. The weighted requirements are calculated as a percentage of the risk-weighted assets (RWA ratio). In addition there is a requirement for the unweighted capital ratio, the leverage ratio (LR), which is calculated as a percentage of total exposures. The LR requirement is designed to act as a safety net.

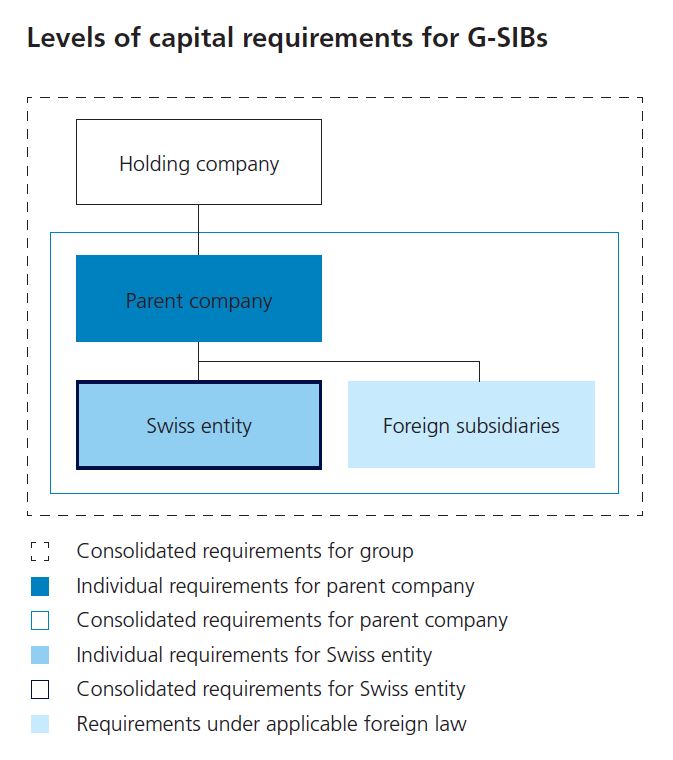

Capital requirements within a group structure

UBS is required to fulfil capital requirements at the following levels in its group structure:

- Requirements for the subsidiaries in which the Swiss systemically important functions are concentrated (UBS Switzerland AG, hereafter referred to as the “Swiss entity”)

- Requirements at solo entity level and on a consolidated basis for the parent company (UBS AG)

- Requirements for the consolidated group as a whole

At ZKB there are consolidated requirements for the group and at a solo level for the parent bank. Similarly, at Raiffeisen there are requirements both for the group at a consolidated level and for Raiffeisen Schweiz Genossenschaft as the central organisation in the co-operative association. At PostFinance, only the requirements for the parent bank are relevant, as it does not have any material group companies requiring consolidation.

Current capital requirements

The going concern capital requirements for all systemically important banks consist of the following three elements:

- A base requirement of an RWA ratio of 12.86% and leverage ratio of 4.5%

- Add-ons for market share in the domestic lending and deposit business and for the size of the bank as measured by total exposures

- Countercyclical capital buffers (applicable to all banks).

The gone concern capital requirements for the domestic systemically important banks amount to a minimum of 40% of their going concern capital. The Swiss entity of UBS is required to hold gone concern funds equal to 62% of its going concern requirements, while the gone concern requirements at group level are 100% of going concern capital less rebates granted by FINMA for improvements in its resolvability beyond the statutory requirements. The gone concern requirements for the parent company of UBS at solo level are the sum of the following elements:

- The gone concern capital transferred to subsidiaries of the parent company

- 75% of the capital requirement for the risks of the parent company as a solo entity vis-à-vis third parties

- 30% of the gone concern requirement applying to the parent company at consolidated level

The 30% requirement of the consolidated gone concern requirements at the parent company level is a buffer designed to be available flexibly in the event of a crisis, for example to recapitalise subsidiaries.

Capital quality

The going concern requirements must be largely met with common equity tier 1 (CET1) capital. Only a maximum of 4.3% of the RWA ratio and 1.5% of the leverage ratio can be met with additional Tier 1 (AT1) capital. These are perpetual debt instruments that are contractually written down or converted to CET1 capital if the bank’s CET1 capital falls below 7% of RWAs. They are commonly referred to as high-trigger contingent convertible / write-off bonds (HT CoCos) and normally absorb losses before a bail-in.

The gone concern requirements are normally fulfilled with bail-in bonds. These are debt instruments that can be converted into equity as part of a resolution procedure. Bail-in bonds are only eligible if they meet certain criteria. In particular, they must be issued by the group holding company under Swiss law and with jurisdiction of the Swiss courts, and may not be offsettable or secured. Furthermore, they must contain an irrevocable clause whereby the bondholders agree to accept a conversion or a full or partial write-down (i.e. a bail-in), if ordered by the supervisory authority.

Bail-in bonds may not be sold in small denominations to prevent these high-risk instruments from being bought by retail investors. Under the Capital Adequacy Ordinance (CAO), the banks may alternatively opt to meet all or a portion of their gone concern requirements with CET1 or AT1 instruments.

Liquidity requirements

The Credit Suisse crisis of 2022 and 2023, the Covid-19 pandemic and the global financial crisis of 2007 and 2008 have highlighted the importance of liquidity for systemically important banks – and thus for financial stability and the Swiss economy.

The amended Liquidity Ordinance (LiqO) has been in force since 1 July 2022. It provides for increased liquidity requirements for systemically important banks with an 18-month transitional period for implementation. By fulfilling these requirements, systemically important banks can absorb liquidity shocks better than other banks. This enables them to meet their payment obligations even in exceptionally stressed conditions. In addition, the liquidity requirement to cover a restructuring or liquidation should be met. The requirements previously in force were inadequate in this respect.

The new regulatory approach for systemically important banks comprises basic and additional requirements. The basic requirements cover risks that are not sufficiently taken into account in the provisions applicable to all banks. FINMA can also impose institution-specific surcharges.

Diversification of risks

Like other banks, systemically important banks are obliged to limit concentration risks. The standard upper limit for such positions is 25% of Tier 1 capital. The difference for systemically important banks is that the concentration risk vis-à-vis other Swiss or global systemically important banks is limited to 15% of Tier 1 capital.